Silicon Valley Bank is my bank of choice when it comes to startup banking. The SVB Accelerator program is pretty sweet choice for startups. No need to go to branches and wait forever to deal with some issue. Great online customer service. No monthly fees. And most importantly great value add in terms of advice, education, and connections.

Recently SVB Analytics held an online seminar "Into the Cloud – Trends in Software Investments and Exits." Interesting topic these days and the presentation was chock full of good information. If you want you can download the presention or listen to the seminar playback via the link above.

They spent a lot of time talking about how the current time is much different than 1999. Concentration of high valuations in a few large companies as opposed to more widespread increase in valuations. The New York Timed DealBook had a nice write up on the same subject, "Investing Like It's 1999." A worthy read.

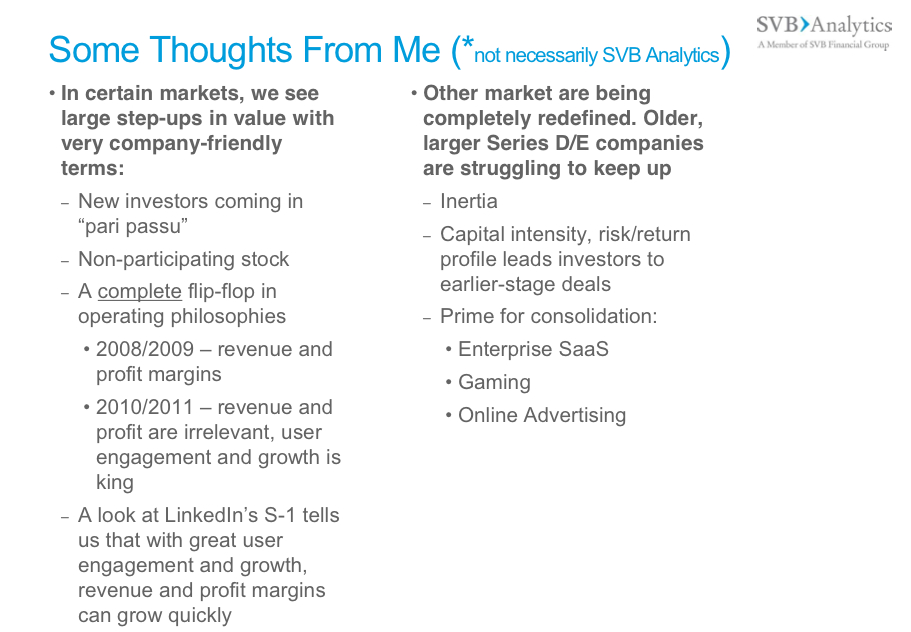

As often happens with webinars I was duel tasking and my attention started to drift until someone put up and started talking about this slide.

I get all the stats. I get all the analysis. But that complete flip flop in operating philosophies from a focus on revenue and profit margins to a focus on user engagement and growth sure make all those backward looking stats a bit less meaningful. And it sure seems familar to me. 1999.