I get the question every week, perhaps at least once a day. "What do you think of the Groupon IPO? That's good for you guys, right?"

To which I reply a hearty "maybe."

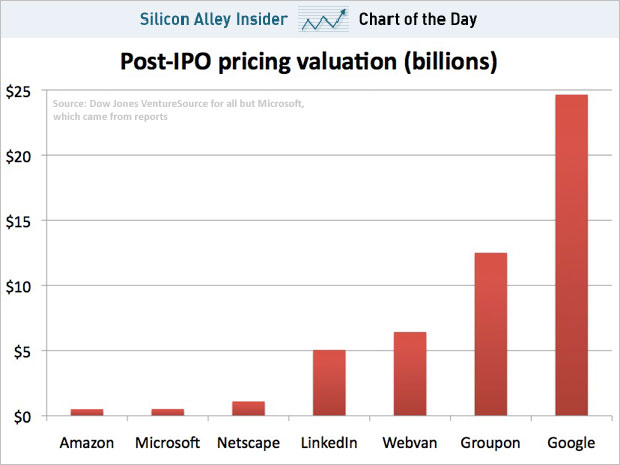

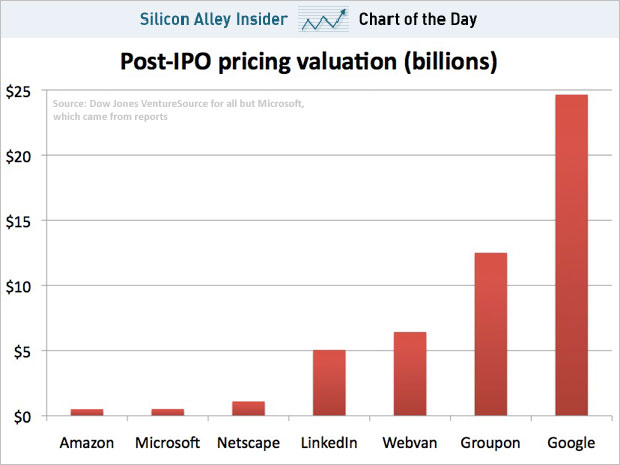

For those of you that have no idea what I am talking about Groupon, the biggest competitor to Half Off Depot where I currently work, went public on November 4. Groupon raised $700 million at a $12 billion valuation. That sandwiches it right between Google and Webvan as the largest IPOs in term of valuation. Interesting company to keep. I considered the Groupon IPO pricing to be a little expensive. Unlike Amazon, a much lower initial value company where I made a nice penny, I wouldn't touch it.

What do I know. The stock was priced at $20, and rose 31% on it's first day. Since then it's been in a slow drift downward. I expect that trend to continue for some time until it gets below the offer price. None of that will stop a bunch of 20 somethings celebrating the end of the lockup period at Kincade's, Sheffield's or wherever 20 somethings go to party in Chicago these days.

But back to the question is it good for Half Off Depot.

One of the things about running through the IPO process is that it generates a lot of general mass media attention. Most of the attention about Groupon was negative. Merchants don't like deals, there is no way Groupon makes money, management is blundering the IPO process. This created a generally negative sentiment around the deal space, one that is going to take a little time to overcome. We have time. And money. A lot of companies do not. They are going to go away soon. Less competition is good for Half Off Depot.

The Groupon IPO also demonstrated that investors see value in the deal space. The mishandling of the IPO process is a little problematic. Groupon got through it, they got out. But along the way questions were asked by investors that have yet to be answered. Until those questions are answered it is going to be difficult for other companies in the space to raise additional capital. Those that do are going to have to be able to clearly articulate why they are different and have a demonstrable money making model with some leverage. If Half Off Depot can do the former and show the latter, and I think we can, the Groupon IPO validated a market where we can play. Having a validated market to participate is good for Half Off Depot.

So the short answer is the Groupon IPO is good for Half Off Depot as it will make it harder for smaller underfunded companies to remain viable and they validated the market in which we participate.

All we have to do is execute on that different money making part. That will keep us busy for awhile.