Leaving ATDC

If you have been following along you probably understand that it has been my intent for some time to leave ATDC and get back into a startup. That time has come. After four plus years of a totally awesome time I have decided to step away from my role as a startup catalyst and resign from ATDC. I’ve had the privilege of being involved with some amazing things during my time at ATDC, working with great startup teams, being on a few teams myself, and playing a small part in making Atlanta a better place for technology startups.

I have had the chance to be a part of a number of companies that have graduated from ATDC. They are BLiNQ Media, Clearleap, Endgame Systems, Izenda, Neurotic Media, PlayOn Sports, Purewire, and WorthPoint. Most of what these companies have already achieved is due to the passion of the founding entrepreneurs and the teams they built. Regardless, one of most rewarding aspects of my time at ATDC is working with these folks to help them build their companies. And there are more on the way.

BrightWhistle, LiquidText, Preparis, Regator, RentWiki, and ScoutMob all show great promise. And these are just a few of the thousands of startups that I have interacted with over the years. Hopefully those interactions created some small gems that helped an entrepreneur in some fashion.

During the past four years I have also been a co-founder of three startups. Skribit, Twitpay, and Socialytics. One of them is in the process of being shut down and the other two are struggling with traction. I have learned that going from zero to something is really hard. And once you have something getting to six figures in revenue is equally challenging.

Skribit and Twitpay came out of Atlanta Startup Weekend, something that I brought to life because I felt the strong need to get a bunch of aspring entrepreneurs together and try to do great things. While we may not have created any lasting companies of value just yet, Startup Weekend played a important role in invigorating the Internet startup sector. Atlanta Startup Weekend lives on as Start Atlanta and continues to build momentum. I dare say it will be around for some time.

I have been involved in more entrepreneurial programs than I can count but BarCamp, CapVenture, Entrepreneurs’ Night, GRA/TAG Business Launch Competition, Junior Achievement Fellows Shark Tank, Tech Marketing Awards, Social Media Atlanta, Startup Council, and Venture Atlanta come to mind pretty quick. I created @secretsig. And SeedSpace.

In my first two years at ATDC I gave them a clue and got on the train of inclusion which resulted in us going from about 30 member companies to 50. Over the past two years Stephen Fleming double downed on that inclusiveness and we are now helping over 440 startups.

And we could not have done any of this without the amazing talent of of MBA graduate assistants. Smart driven people that love startups. They really do make the place go.

And there are some amazing things that are about to happen at Georiga Tech that make it hard to walk away. I love Flashpoint and have been working to get it off the ground. If the timing were different I would do that full-time. But it has been too long. I am confident that under Nina Sawczuk’s leadership ATDC will continue to increase its impact on technology entrepreneurship in Georgia. My face will be seen in Tech Square supporting what ATDC is doing from time to time.

But at my core I love to grow Internet companies. To be in one. I found one that needs growing. That is what I am going to do.

Internet Entreprenuers @ Digital Summit

So the first ever Digital Summit is taking place in Atlanta next Monday and Tuesday. If it is anything like the Internet Summit held in Raleigh every year this promises to be a good show.

I am looking forward to the venture capital, online advertising, and future of media sessions as well as the keynote by Gary V. I am fortunate enough not only to be an active participant but have the opportunity to jump up on the stage with four entrepreneurs. I am going to be moderating the Internet entrepreneurship panel.

I will be talking with Jamie Bristow Founder, Mynonprofitmatch.com; Mitch Free CEO & Founder, MFG.com; Tim Harrington CEO, eRollover (now FiPath); and Michael Tavani Co-Founder, Scoutmob on Tuesday afternoon. Good group. I know Mitch, Tim, and Michael pretty well and look forward to meeting and learning more about what Jamie is up to. By the time we get to our part of the agenda we will be the only thing standing between the crowd and the bar so we intend to have a snappy fun time.

This bad boy is about to sell out. ATDCF50 gets you $50 off the price of admission. Regardless of if you are going or not what do I need to ask this esteemed group?

Flashpoint At Georgia Tech

Yesterday was a big day at the ATDC Startup Showcase. First and foremost nine companies graduated from ATDC. Not to take anything away from the success of these amazing companies and entrepreneurs but in the big scheme of things that may have been the smaller story.

The bigger story is that Georgia Tech announced that they were going to own the problem. They were pulling an Ohio.

In a nutshell in conjunction with Imlay Investments, Georgia Tech is launching a 21st century technology accelerator program. I have been involved with a small team led by Merrick Furst and Nina Sawczuk to bring this new technology accelerator to life. It is scheduled to launch on May 17. If you would like to find out more a visit to flashpoint.gatech.edu is in order.

Join A Startup

Remember that post about FU Money? Here's another one.

I see a problem almost every day with people working their plan to get some FU Money. They only take one path and often time it is the wrong one. The way I see things there are five ways to get FU Money.

Marry it. Don't know anything about this.

Inherit it. Not that interesting to talk about.

Start a company that requires large outside investment. Much more interesting to talk about. But the brutal facts of reality are that your odds of success are really, really, really small. They are particularly small when you have no cash resources, domain knowledge, startup experience, or skills to make a product. People like this walk into my office every day. Many not only have small odds, they have no chance. I even have a term for them. NC. Don't be this person.

Start a company that does not need outside funding. Very smart path for the first time entrepreneur. Dave Wright did it with JungleDisk. David Cummings with Hannon Hill. Tim Dorr with A Small Orange. The Lacours with ShootQ. Ben Chestnut and the rest of the MailChimp team. Get a win. Have a great life. Go bigger.

Join a startup. It's not just the founders that get FU money, its the people that make things happen. Remember, SecureWorks minted thirty something millionaires. Be one of those. The number of people that have taken this path and then started their own company with cash resources, domain knowledge, and startup experience is countless. But with the exception of old dudes that want to jump into a funded startup at some high salary and run it or do strategy I do not see many people pursuing this path. This is the path that the majority of people need to be taking. Find an area of interest, find the startups that include equity as part of their comp package, figure out how you can help the startup, and join it as an early employee.

Deals, Deals, Deals

Nice top level summary of a really big and interesting space.

So big and interesting that Google, the company with the largest market cap, is the dog. Regardless I think Jim Crowley, the CEO of BuyWithMe, pretty much got it right when he told Crain's "There is room for six of seven large players as well as niche players."

But Google the underdog? How do you suppose they are going to change that? If I were Jim Crowley I know what my answer would be.

Executive Summary Examples

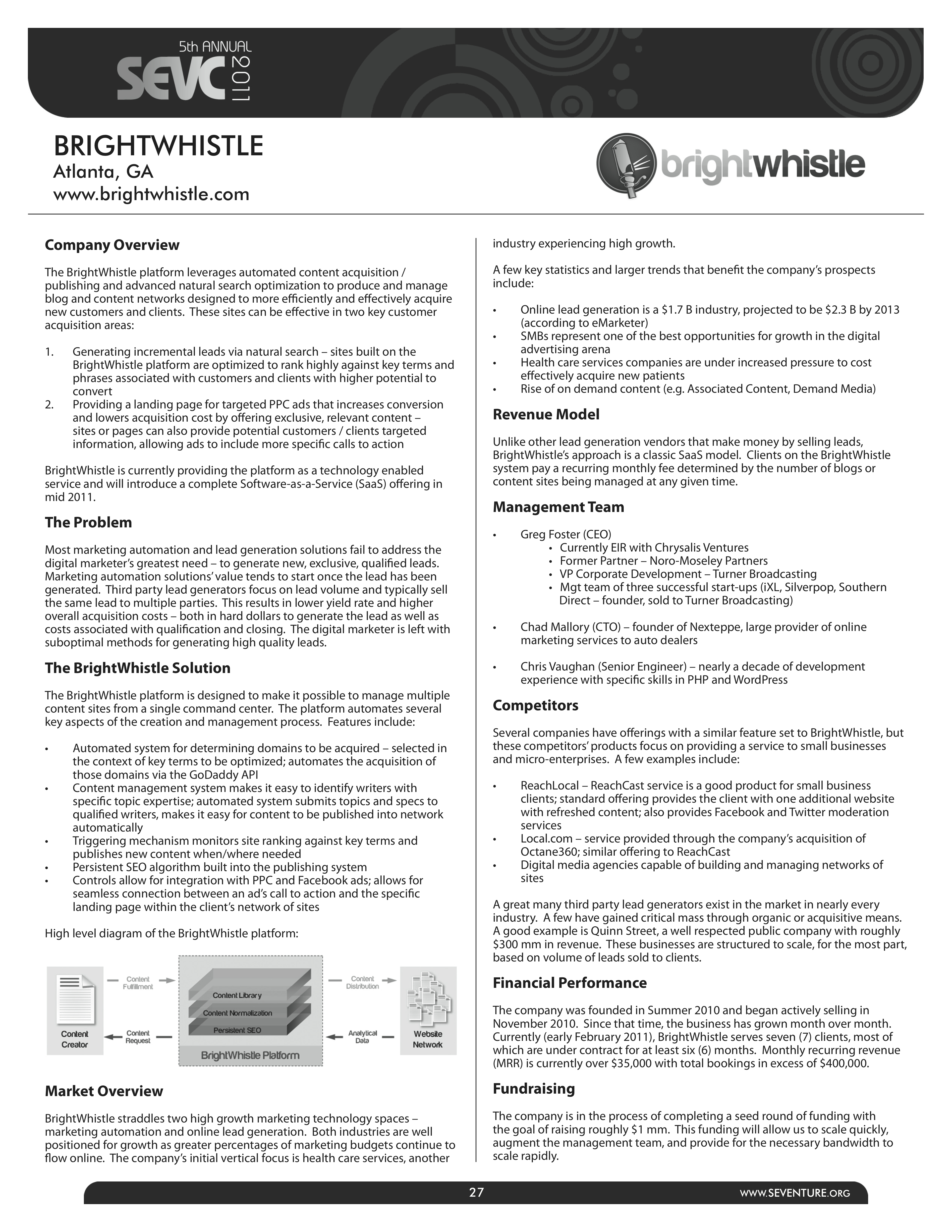

When I was thumbing through the executive summaries at the 5th annual SEVC back in March I paused to read the BrightWhistle executive summary a bit more deeply. I had been working with co-founders Greg Foster and Chad Mallory for a while and wanted to see how they were presenting BrightWhistle at its coming out party. It was one of the best seed stage executive summaries that I have ever read and I have read a lot of them. Eric Gregg of TechMedia was kind enough to provide me with a digital image of Brightwhistle's executive summary for publication here.

It was written about seven months after Brightwhistle was formed. The company had little operating history. Often times entrepreneurs struggle with adequately describing their companies at this stage. This is a great example that can serve as a template for others. Toward this end Greg offered to provide me with Word docs of both the BrightWhistle and StatSheet (which Greg also penned) executive summaries. They are below.

Seed Stage Compensation

So we have been talking a little bit about startup compensation across the nation and in Atlanta. Today the subject is seed stage compensation. In particular for those companies that have raised a typical angel round, say $500k.

Before going there it is helpful to summarize later stage startup compensation. Abby and I had a brief text exchange this week to help her with some work at one of her startups. This is what I wrote:

Here is a general way to think about it.

$200 ceo

$150 vp

$100 director

$66 manager

$44 coordinator

Plus or minus 10%

Individual contributors with specialized skill set $50 – $120 depending on skill and experience.

These numbers are based on my experience at venture backed startups as well as discussions with venture backed CEOs. So what about the earlier companies? Those that are angel funded.

There are no studies that I am aware of specifically on angel funded companies. But I know one thing, the numbers are lower than those above. A lot lower. That angel investment has to last a year or two. The spread between the CEO and the other people working at the startup is also a lot less.

While the standard deviation is huge, some founders take no money at all until their business can pay them or they raise a larger round, I venture to say that your average founder with significant domain knowledge and/or startup experience (its easier to just throw the titles away for this discussion) makes between $75,000 and $100,000. There is no bonus program. The employees, those with specialized skills, earn about 75% of what they might make at a venture backed firm. Sales people can earn full salary if they hit their numbers but the comp plan is highly leveraged. On a equity front the founders have whatever they agreed to and the employees have access to a 5% to 10% option pool.

These are my thoughts. I would love to hear yours.

Startup America Reducing Barriers Question

So I am attending the Startup America roundtable on Monday afternoon. They asked me to think about the answer to one question. Here’s the question.

What has been the most significant barrier to starting or growing your business and creating more jobs, and how can that barrier be reduced?

What would you say?

Open Social Network Experiment

So back at the beginning of Lent I did something that I am prone to do. A little online experiment. I opened up my social networks.

At the time they looked something like this:

- LinkedIn 892 contacts, 363 requests

- Twitter 2,774 followers, 331 following

- Facebook 386 friends, 83 requests

- Foursquare 88 followers, 120 requests

So I opened things up. I essentially accepted all requests and followed back on everything that seemed like a real human.

Six weeks latter I have 1,273 LinkedIn connections, 2,908 Twitter followers while following 479, 475 Facebook friends, and 224 Foursquare followers. From a percentage basis the size of my social networks have grown as such; LinkedIn up 43%, Twitter up 9%, Facebook up 23%, and Foursquare up a whooping 155%. All in my social connections are up to nearly 5,400, a 20% growth rate in six weeks.

Here is how the growth impacted my user experience.

Facebook felt fundamentally the same.

Aside from a inane request from someone that I do not know asking me to do something that takes time with no apparent benefit to me, I noticed no change on LinkedIn, the network with one of the higher growth rates.

Foursquare in essence operated the same. In essence. From time to time in the back of my head I thought about the potential Foursquare stalker problem. Not sure if I am going to do anything about it but it does reinforce some of my thoughts on the limits to the size of location based social networks.

Twitter, with its measley 9% growth, became unusable. Without spending significant amount of time reading through updates of no interest or adopting a more sophisticated client to filter results Twitter literally lost its value. I stopped using it. At least for me, indiscriminately following back on Twitter is a bad strategy. So I am going to be cleaning up my following list and in the future be more selective about those who I follow.