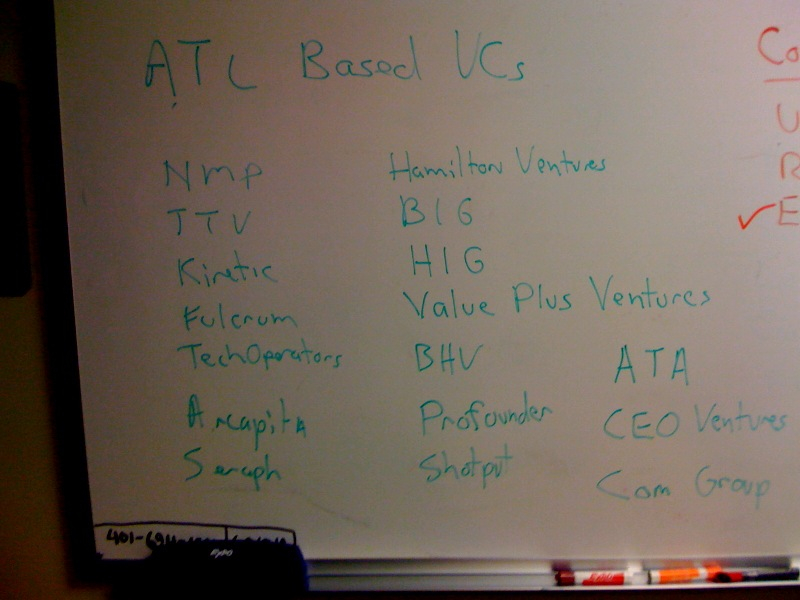

Last night was the monthly meeting of the Atlanta Technology Angels. It is the first ATA meeting I have had an opportunity to attend since Mike Eckert became chairman and executive director of the group. And oh my gosh what I difference. To give you some flavor the last ATA meeting I attended in Q3 of 2010 had about 20 angels in attendance. Last night close to 50. And they are getting active.

You may have read about ATA investing in HireIQ. In addition to that deal ATA currently has a term sheet signed, is in due diligence with another company, and has some individual investors moving forward with a third deal. Moreover ATA has already completed three follow on rounds in 2011. Of the four new deals mentioned above, two of them are seed stage investments in pre-product companies.

On top of all this activity one of the most interesting things to watch during the meeting was angels championing startups that pitched. Very passionate support for entrepreneurs.

As part of its evolution ATA has constructed three different deal types that they are interested in pursuing.

One are seed deals. To ATA a seed deal is a $100k or less round into a large well supported market, with a clear understanding of competitive advantage, a preliminary business model, and a team. A member of ATA or other early stage entrepreneur support entities such as atdc must champion seed stage deals. Part of my day job at atdc is to refer the best seed stage deal I see to ATA every month (one of them is in due diligence).

Two are core deals. Core deals are your more historically typical angel deals in the $250k to $1 million range. For core deals ATA is looking for early market traction in a sizable market, an experienced management team with domain knowledge, an exit strategy to liquidation within five years, and a valuation no higher than $3 million.

Three are opportunistic deals. Opportunistic deals are exactly that. As an example I recently discussed a company with Mike Eckert that was raising $1 million on a $9 million valuation. The company has significant revenue traction so Mike met with the CEO to determine if it was a potential fit.

ATA has taken the step to put their investing criteria online. They have also put their seed and core applications online. They are below.

The Atlanta Technology Angels are resurrecting themselves. They are becoming a source of capital that any entrepreneur seeking early investment should consider for one simple reason. They are doing deals.