Rocky Agrawal seems to be all worked up about the online local commerce world. I am not exactly sure why, but over the course of the past few days I have gotten quite a few notes about his Why I Want Google Offers And The Entire Daily Deals Business To Die article on TechCrunch. It is one of a series of articles about the online local deal industry.

The specific article above seems somewhat akin to a certain president wanting to attack a certain country to take out a certain leader. I don’t really understand why as Rocky seems to be a pretty rational strategic thoughtful deal industry guy. As an example he has a great article on Best Practices for Businesses Considering Daily Deals. Here’s the first section.

Before you agree to a deal

- Make sure deals is right for you. The marketing around daily deals implies that it’s an honor to be selected and that you should be thankful for the opportunity. It’s the “Who’s Who” model — flattery works. It’s not an honor. You should analyze the numbers and make sure that the deals work for your business. Talk to other similar businesses about their experiences. Some of the key questions to ask: How many of the customers were your existing customers? How big was the initial demand? Did you have to staff up extra? Did people buy more than the deal value? Did new deal customers come back? If the deals were redeemed mostly by existing customers or new customers didn’t come back, those are bad signs. Only run a deal because you have done analysis and realized that it’s good for your business, not because everyone is excited about Groupon. I talked to one merchant who ran a Groupon because a restaurant across the street was full after it ran a Groupon. She ended up losing $10,000 on her deal.

- Don’t believe statistics from your sales rep. The reality is that none of the deal companies have the technology to accurately track the most important metrics to the business. You’ll hear stats like 95% of merchants are satisfied. 98% spend more than the deal voucher. You should ignore them. 95% of people wouldn’t agree that the Pope is Catholic. On a $20 Groupon, they might spend $20.05. Yes, it’s more than the voucher, but that extra nickel doesn’t help you.

- Stick to your guns. Your sales rep might tell you that in order for your deal to be selected to run that you must make your offer more generous. By, for example, increasing the cap or raising the value of your voucher or increasing the share to the deal company or removing restrictions on a deal. This is akin to the car salesman telling you that his manager won’t let him do the deal. If you’ve worked out your numbers and know what your comfortable with, stick with them. “Losing” the opportunity to be featured is better than making a bad business decision.

- Make sure you understand the terms. The daily deal is not some Internet magic; it’s a complex financial instrument. The dynamics are very different from buying a newspaper or magazine ad. Give it the same amount of thought as if you were taking a $15,000 loan. See my analysis of the Groupon merchant agreement.

While much of Agrawai’s writing is thoughtful like the as the above demonstrates major points are either overlooked or ignored in the TechCrunch rant.

- Despite some high pressure sales techniques by some companies in the space no one is forcing merchants to sign up for online local commerce deals.

- Many merchants love deals and are signing up for annual contracts with specific providers.

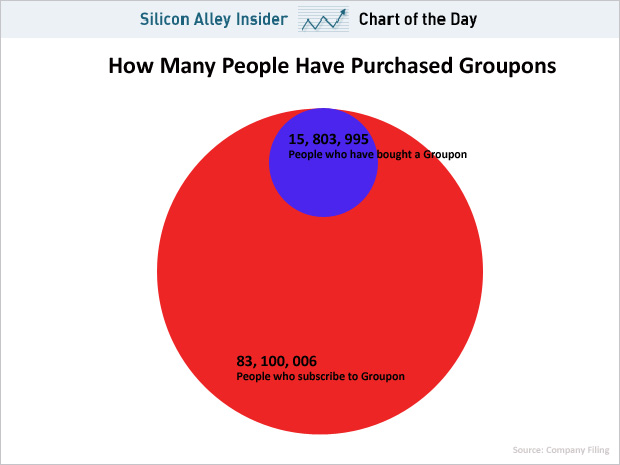

- There is no concept of consumer frequency in his analysis.

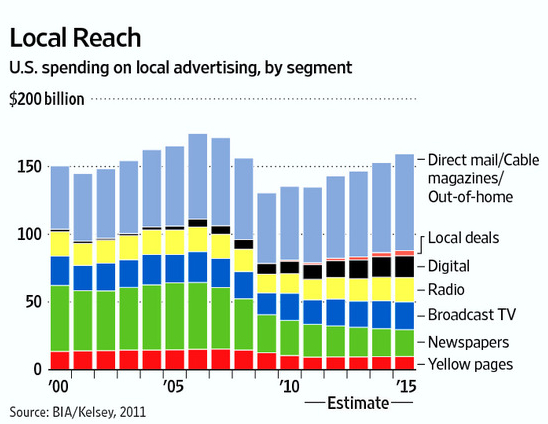

- Daily and weekly alternative newspapers are dead or dying. Deal companies are one of the few alternatives that local merchants have to market themselves.

- Deal companies are performance based with real metrics.

Rocky closes the TechCruch article with this:

If you know of a business that has run a daily deal and since closed please email dailydeals@agrawals.org

Why the axe to grind? That I don’t know.

Agrawai refers to Google Offers as “pretty close to evil.” I signed up for my current gig at Half Off Depot to do good not evil. We are providing real value to both merchants and consumers. If anyone wants to know of hundreds of businesses that are thriving as a result of online local deal marketing drop me a line, I would be more than happy to connect you with a few of them.