This week I was interviewed for an upcoming article in the Atlanta Business Chronicle on the subject of how innovation is driving economic development (job growth in layman’s terms) and what needs to be done to continue to attract and foster startup companies. This led me to think about the subject a bit and this is what I scratched down on a bunch of post-it notes in about 10 minutes.

First and foremost successful entrepreneurs are taking a leadership role. Notably Tom Noonan has been at it for quite some time and more recently David Cummings and Paul Judge are two younger successful entrepreneurs that are staying in the game and fostering new startups. The noise of successful entrepreneurs retiring and not giving back is fading. I expect to see this trend continue and it needs to. Healthy startup ecosystems are entrepreneur led.

Second we have seen a proliferation of startup seed funds. Atlanta Ventures, BIP Early Stage Fund, BLH Ventures, Tech Square Labs, and Tech Square Ventures are all active seed stage funds that were not around eight years ago. When you lay this on top of the older more established seed stage investment community it seems to me that there is money to be had for the right team and concept.

Third there has been a huge increase in the number of accelerators/incubators in town. We have gone from just ATDC back in 2006 to 4Athens, Atlanta Tech Village, Collider, Flashpoint, Founders’ Institute, Maverick House, NeuroLaunch, Startup Chicks, and Switchyards to name a few. Yes we are in a bit of a technology bubble. We might even have a technology accelerator bubble in Atlanta. More is good. Budding entrepreneurs have a lot of places to turn for help.

Fourth we are seeing cluster development. It used to be just information security. Now we have healthy infosec, financial technology, healthcare technology, and marketing technology clusters.

Finally local and state government have become more supportive of startups. These entities have come to realize how new jobs are generated by innovative new companies and are eager to help. The mayor, the chamber, and the state legislature all seem to have a big interest and are taking action towards helping startups. There have been several laws passed to encourage investment in startups. Great progress. There is one more thing that I believe that our government can do to further foster the growth of startups and economic development.

The number one thing that startups need are customers. Nothing is worse than a local startup with good technology losing a deal with a local company to a better funded, better known out of state startup. While governmental focus on encouraging investment is a great step, governmental focus that would help startups get more customers may prove more fruitful. I believe our local and state government should encourage, even offer an incentive, for larger Georgia companies to do business with Georgia startup companies. In my mind a modified Georgia Entertainment Industry Investment Act geared toward providing a tax incentive for larger Georgia companies to do business with Georgia startups would be jet fuel to grow innovative technology startups and a winning economic development strategy.

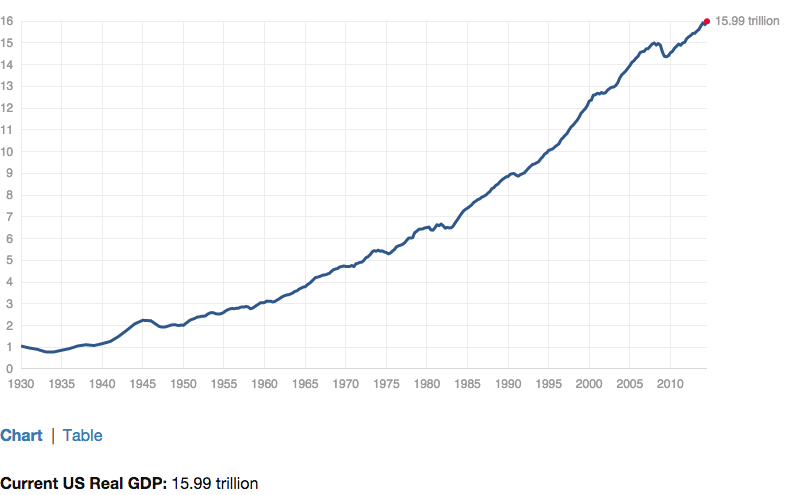

If you throw such an economic development strategy on top of the progress the Georgia startup ecosystem has made in the past decade I believe that you would see exponential growth in the system. Regardless of government action for the reasons outlined above I firmly believe there will be healthy growth in Atlanta startups and innovation over the coming years.